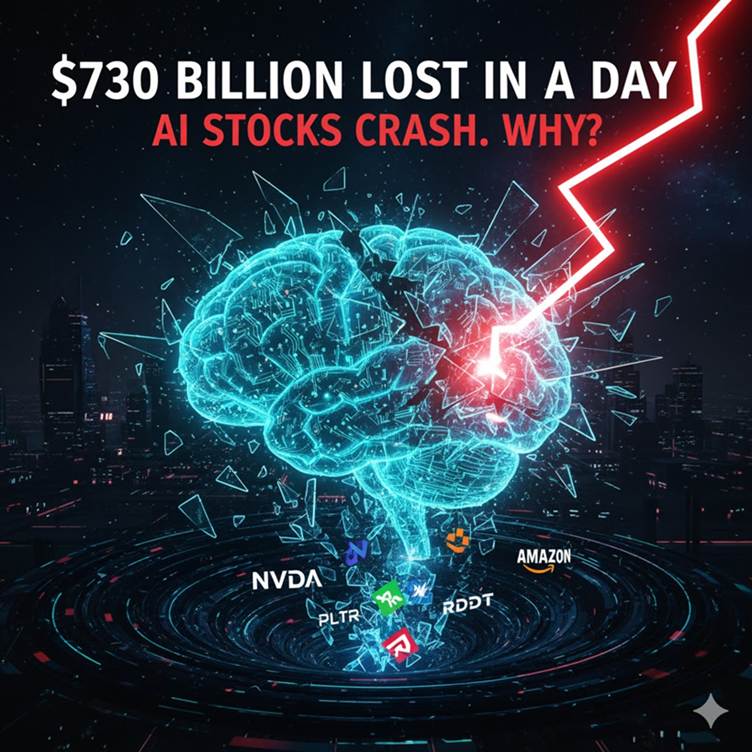

In just one single day, global tech markets lost nearly $730 billion in value. Stocks that were leading the world’s biggest AI rally suddenly crashed — shocking investors everywhere. For almost a year, anything related to AI was treated like a guaranteed jackpot. If a company mentioned “AI”, the stock went up. No questions asked.

This was the first real warning that the AI boom may now need a reality check.

Why Did This Crash Happen?

1) Michael Burry Bet Against AI

Michael Burry (the same investor who predicted the 2008 crisis) revealed a massive $1.1 billion short bet against Nvidia and Palantir — two of the biggest AI winners.

His message was indirect but strong:

“Sometimes the only winning move is not to play.”

That single signal created fear.

Investors thought — “If he thinks AI is going to fall… maybe we are in a bubble.”

This triggered panic selling.

2) Valuations Went Too High, Too Fast

AI companies are growing — but their stock prices grew MUCH faster than their actual revenue and profits.

Example:

- Nvidia became a $5 trillion company

- Palantir reported 63% revenue growth

- Amazon signed a $38 billion AI deal

Business is real.

But prices were priced for “perfection”.

Markets began to worry the hype was running ahead of reality.

3) Global Investors Started Booking Profits

Many big funds used this moment to sell and lock profits.

This created a domino effect → one sells → others follow → you get a free-fall chain reaction.

4) Market Mood Shifted to Fear

The belief that AI stocks can NEVER fall finally broke.

For a year people thought AI = permanent safety trade.

This crash reminded everyone that even AI cannot escape:

- inflation risk

- liquidity tightening

- high-interest uncertainty

- psychological fear

The market became emotional again.

How Bad Was the Damage?

| Company/Region | Drop |

| Nasdaq | >2% |

| Nvidia | ~4% |

| Palantir | ~8% |

| >8% | |

| Amazon | ~2% |

| SoftBank | ~10% |

| Nikkei Index | ~2.5% |

Billions disappeared faster than they were created.

So Is the AI Bubble Bursting?

No.

The crash does NOT mean the AI revolution stops.

It means valuation madness is slowing down.

AI is real.

The money is real.

The future impact is real.

But the era of “anything AI goes up automatically” is ending.

Final Takeaway

This was not the collapse of the AI industry.

This was a warning to stop assuming AI stocks can only go up.

The stock market still runs on human emotion — not machine intelligence.

And yesterday, fear went viral.