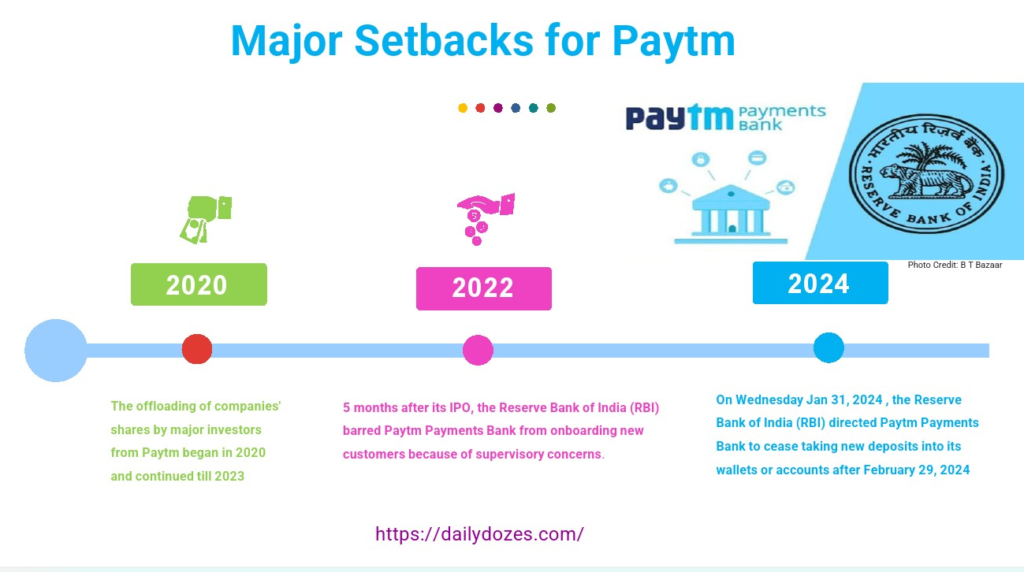

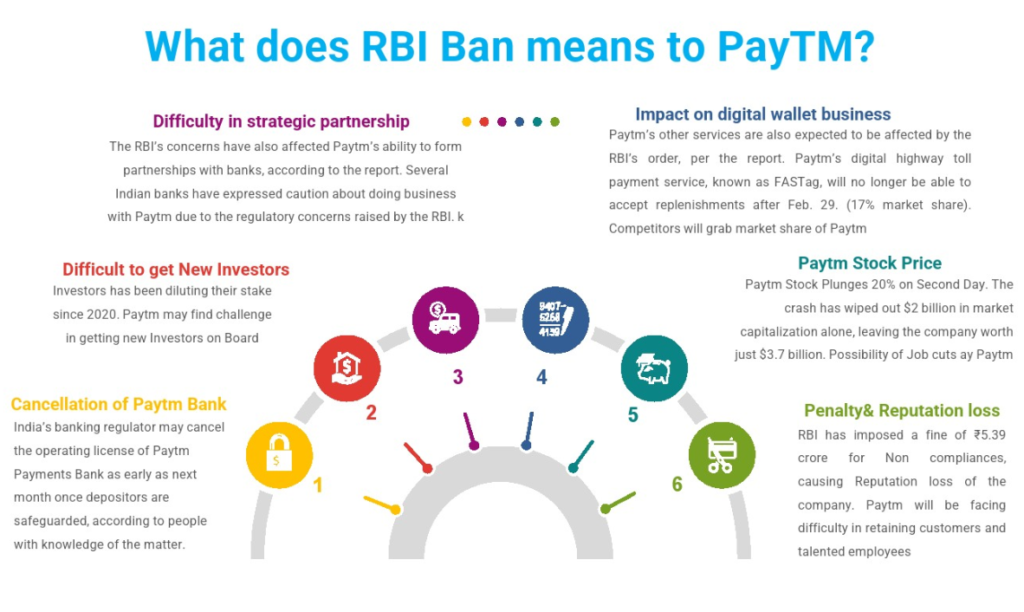

In an unprecedented move, the Reserve Bank of India (RBI) has decided to ban Paytm, one of India’s most popular digital payment platforms. This action has left many people surprised and raised many questions regarding the functioning and regulation of fintech companies.

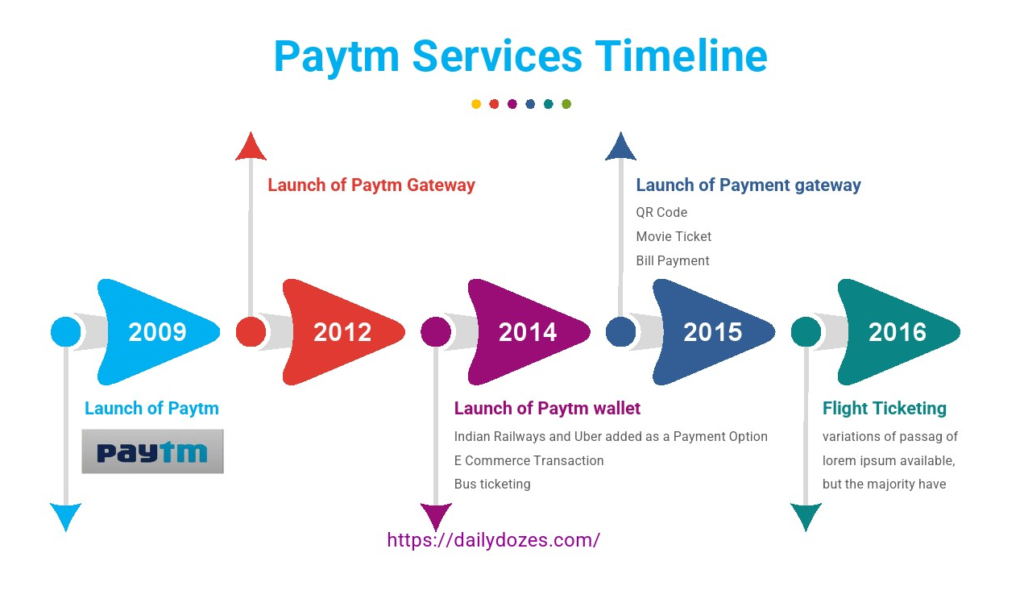

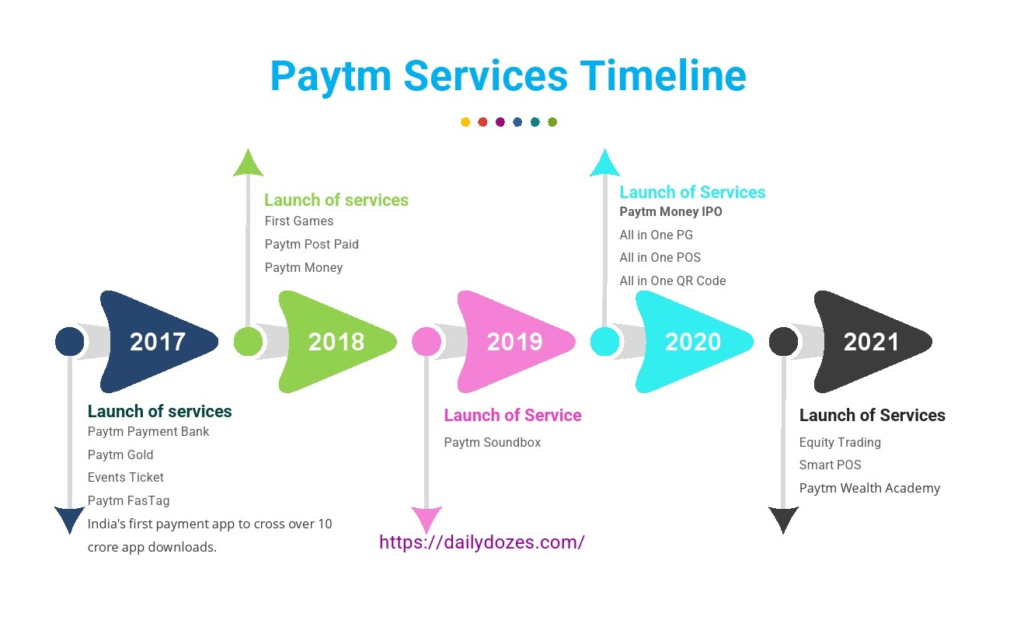

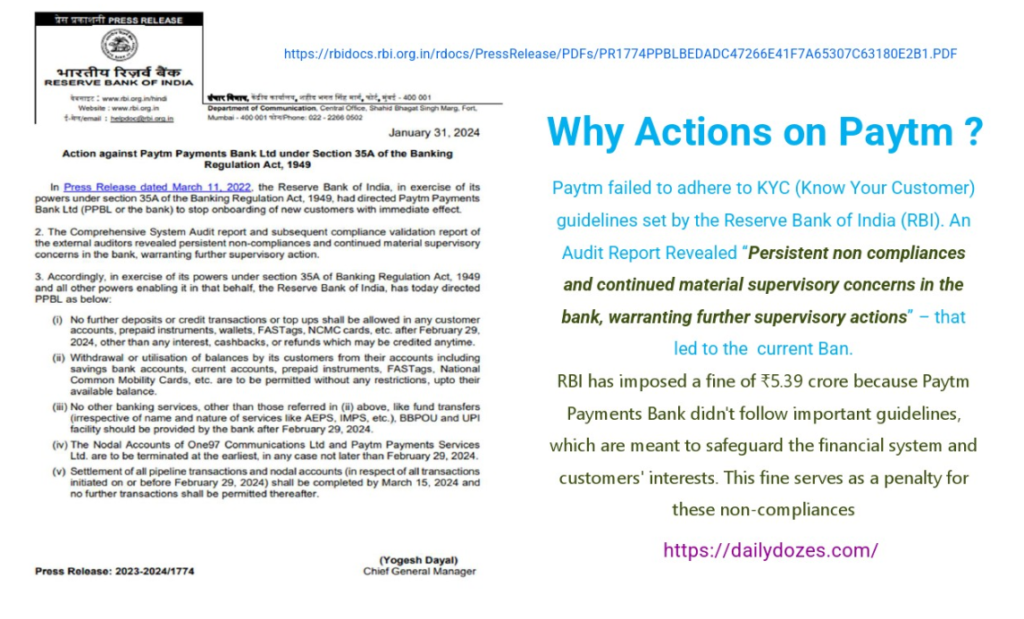

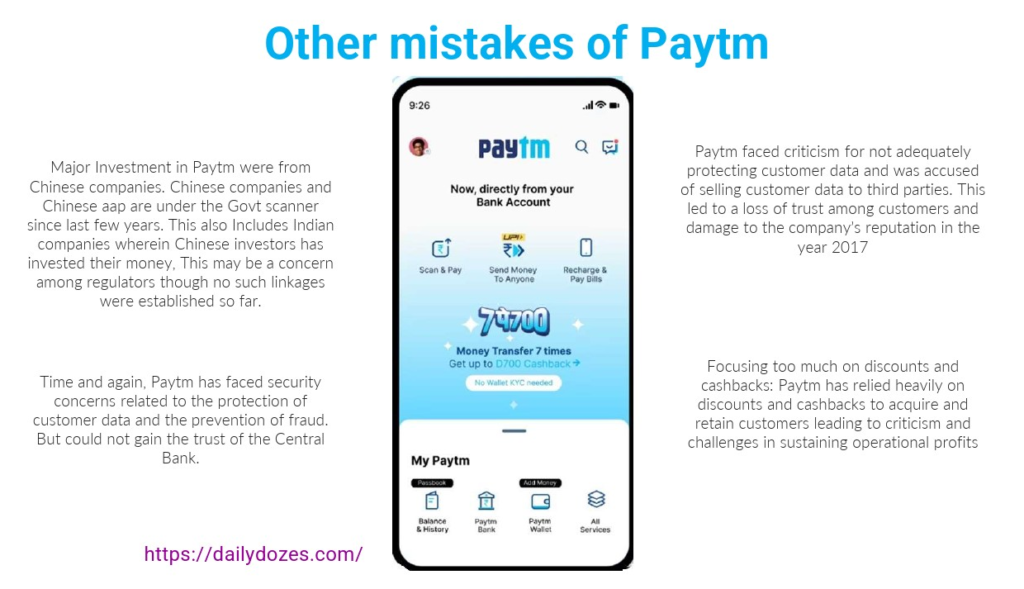

Before understanding the reasons for the ban, it’s essential to examine the series of events that led up to this outcome. The significant timeline begins with the RBI’s extensive review of Paytm’s operations, followed by various customer complaints regarding the misuse of data privacy and potential security threats. These events and more compelled the regulator to take a hard look at Paytm’s operations, which eventually led to the unprecedented ban.

RBI Circular

While the ban has had significant implications, it also serves as a learning opportunity for other fintech companies to navigate the regulatory environment better. It emphasises the importance of robust data security measures, adherence to legal provisions, and, above all, the consequences of ignoring them. This situation provides a crucial lesson in the importance of regulatory compliance, ethics, and proactive measures in the world of fintech. We can only hope that Paytm will come out of the turbulence situation soon.