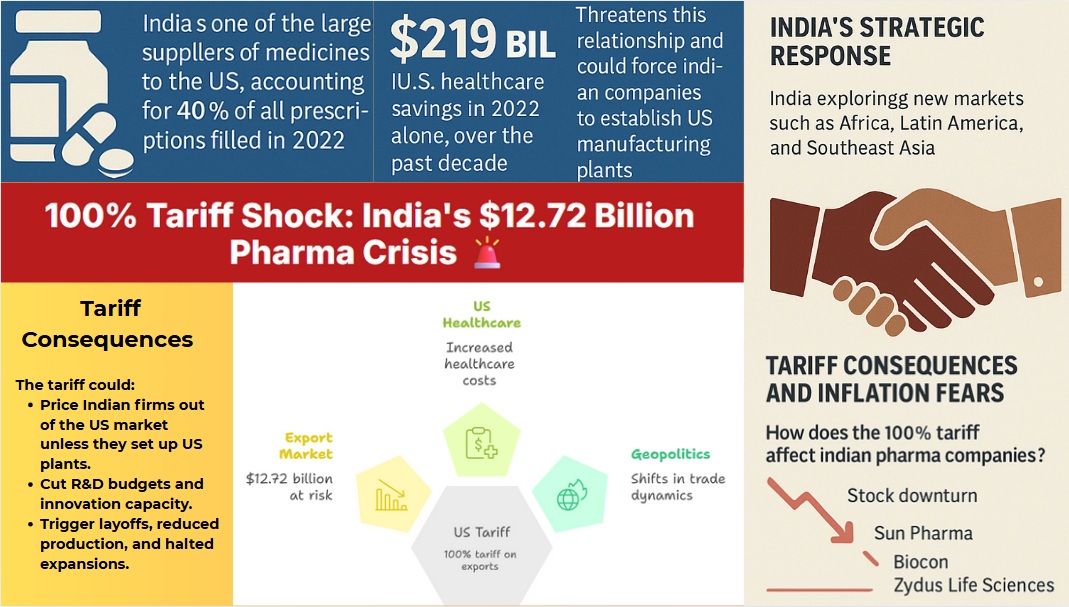

The announcement of a 100% tariff on pharmaceuticals by the Trump administration has jolted the Indian pharmaceutical sector and raised alarms across global healthcare markets. The decision, made abruptly and without prior consultations, directly targets India’s $12.72 billion pharma export market to the US — a market that has long served as the backbone of affordable medicines for millions of American patients.

For India, the move is nothing short of a political and economic shock. For the US, it raises uncomfortable questions about healthcare affordability, inflation, and whether protectionism is taking precedence over patient needs.

India: The Pillar of Affordable Medicine in America

India has long been recognized as the “pharmacy of the world.” By 2022, it supplied around 40% of all prescription drugs sold in the US, especially low-cost generics that helped keep healthcare costs under control.

👉In 2022 alone, Indian generics saved the US $219 billion.

👉Over the past decade, these medicines delivered $1.3 trillion in savings to American patients and insurers.

The new tariff threatens to dismantle this foundation. If the 100% duty is enforced, Indian companies will be priced out of the US market unless they set up costly local manufacturing facilities — a demand that may not be viable given the industry’s razor-thin margins.

This could mean fewer resources for R&D, weakened global competitiveness, and a shift in focus away from innovation.

Tariff Consequences: Market Shock and Inflation

Indian pharma stocks reacted instantly: Sun Pharma, Biocon, and Zydus Life Sciences all saw declines as investors braced for uncertainty and revenue hits.

The risks are multifold:

👉Revenue losses: Indian firms may scale back production or delay expansion plans.

👉Jobs at risk: Layoffs and cost-cutting could follow reduced US market access.

👉Inflationary pressures: In India, companies may hike domestic prices to offset losses.

👉Higher US drug prices: For American patients, the tariffs could undo years of affordability gains.

The ripple effect will be felt far beyond stock markets. US patients could face a sharp rise in drug prices, and India’s economy — already navigating global headwinds — could see additional inflationary strain.

India’s Strategic Response: Diversifying Beyond the US

India is now moving to reduce dependence on the US market. Key strategies include:

👉Strengthening exports to Africa, Latin America, and Southeast Asia — regions with expanding healthcare demand.

👉Tapping into China: Despite political complexities, China’s massive population presents a huge growth opportunity.

👉Boosting innovation and quality: The government is encouraging pharma firms to invest in R&D and advanced manufacturing to hold their competitive edge.

The Pharmaceuticals Export Promotion Council of India (PharmaExcil) is already spearheading efforts to identify and build partnerships in emerging regions. This diversification is not just a defensive measure but a long-term play to position India as a global pharmaceutical hub beyond America’s influence.

The Geopolitical Game: Energy vs. Pharma

The tariffs cannot be viewed in isolation. They reflect a broader US strategy where trade policy is being weaponized for geopolitical leverage.

Washington has been pressuring India to reduce its reliance on Russian oil and pivot towards US energy exports. Analysts suggest the pharma tariffs may be a bargaining chip, nudging India into alignment with US energy interests.

Chris Wright, the US Energy Secretary, framed the issue as “moral and strategic,” but the underlying message is clear: America is willing to disrupt a vital trade sector to secure energy partnerships on its terms.

This protectionist shift underscores the fragile balance of US-India relations, where cooperation in technology and defense now sits uneasily alongside clashes in trade.

Looking Ahead: India’s Balancing Act

India’s challenge is twofold:

👉Safeguard its pharma sector — ensuring stability for a $50+ billion industry that employs millions and serves as a global public good.

👉Navigate diplomacy with the US — avoiding escalation while securing relief from a decision that could hurt patients in both nations.

The Modi government is expected to:

👉Intensify diplomatic talks with Washington to roll back or soften the tariff.

👉Boost domestic resilience with incentives for R&D and bulk drug manufacturing.

👉Expand alliances with regions less susceptible to protectionist shocks.

Conclusion: A Test of Resilience and Diplomacy

The 100% tariff on Indian pharmaceuticals is more than a trade measure — it is a stress test of India’s economic resilience and diplomatic strategy.

For India, it is a wake-up call to accelerate diversification, foster innovation, and build new trade alliances. For the US, it is a gamble that risks inflating healthcare costs for millions of its own citizens.

The next few months will be crucial. If India can weather the storm and reimagine its pharma exports, this crisis may well become a turning point — strengthening its global standing as the true pharmacy of the world.

Discover more from DailyDozes NEWSPAPER

Subscribe to get the latest posts sent to your email.