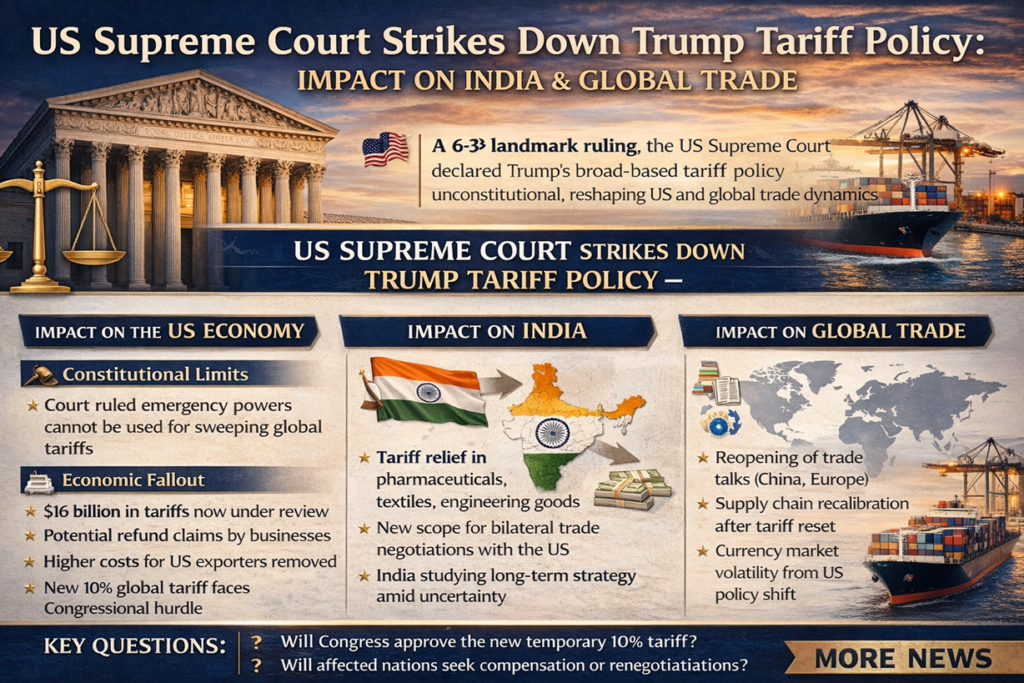

In a historic 6–3 ruling, SCOTUS invalidates sweeping tariff regime — Trump counters with a 10% global tariff proposal; India and world markets recalibrate.

Breaking: Supreme Court Voids Trump Tariff Policy in Landmark Ruling

The United States Supreme Court has struck down former President Donald Trump’s sweeping global tariff regime in a landmark 6–3 decision, ruling that emergency economic statutes do not authorise blanket import duties without explicit Congressional approval. The ruling — one of the most consequential trade governance decisions in decades — immediately reshapes US trade policy and sends shockwaves across global markets, including India.

Trump responded swiftly, issuing a fresh executive order proposing a temporary 10% global tariff valid for 150 days, contingent on Congressional approval. Whether lawmakers — unconstrained by strict party discipline — will rubber-stamp the order remains deeply uncertain, especially with the President’s approval ratings hovering near 30%.

SCOTUS Ruling on Trump Tariffs: Constitutional Earthquake in Trade Policy

The Court’s majority opinion established two bedrock principles that will govern executive trade authority going forward:

- Emergency economic statutes — specifically the International Emergency Economic Powers Act (IEEPA) — do not confer authority for across-the-board global tariffs.

- Reciprocal tariff regimes require explicit, prior Congressional authorisation — not merely post-hoc legislative acquiescence.

Legal scholars describe the verdict as a defining precedent on the boundaries of presidential emergency powers in economic diplomacy. By reasserting Congress’s constitutional role as the primary arbiter of trade policy, the Court effectively curbs a decade-long expansion of executive unilateralism in tariff-setting.

Economic Fallout: $16 Billion in Tariff Collections Under Review

The financial implications for American businesses are immediate and substantial. Nearly $16 billion in tariff revenue collected under the invalidated regime may now be subject to judicial review. Importers and manufacturers — many of whom absorbed cost increases that were passed on to consumers — are expected to file refund claims as courts process the ruling’s downstream effects.

American exporters, meanwhile, may benefit from the anticipated rollback of retaliatory tariffs imposed by trading partners. However, short-term market volatility is likely as investors recalibrate positions around the uncertainty of Congress approving Trump’s proposed 10% substitute tariff.

Impact Summary: United States

| Area | Immediate Impact |

| Tariff Collections | ~$16 billion potentially under judicial review |

| Business Refund Claims | Importers likely to seek reimbursements through courts |

| American Exporters | Relief from retaliatory tariffs expected |

| Financial Markets | Short-term volatility; medium-term recalibration |

| Congressional Authority | Reasserted as primary trade policy body |

Impact on India: Export Relief Meets Strategic Uncertainty

India was among the hardest-hit emerging economies under Trump’s tariff brackets, facing levies of 18–25% across key export categories including pharmaceuticals, textiles, and engineering goods. The Supreme Court’s ruling immediately reduces that pressure — but long-term trade certainty remains elusive pending Congressional action on the proposed 10% substitute tariff.

Key Sectors Set to Benefit: Pharma, Textiles, Engineering Goods

Indian pharmaceutical exporters — who collectively ship billions of dollars of generic medicines to the US annually — stand to see improved margins if the invalidated tariff brackets are not replaced by equivalent Congressional measures. Similarly, textile and garment manufacturers, and engineering goods exporters, may find renewed price competitiveness in the American market.

New Delhi is adopting a cautious, calibrated approach. Government sources say India is closely studying the ruling’s implications before altering its bilateral trade posture. The verdict opens fresh negotiating space for a recalibrated India-US trade dialogue that had stalled amid tariff tensions.

Politically, Opposition leader Rahul Gandhi has alleged that the Modi government made undisclosed concessions under US pressure during the tariff standoff. Government sources firmly contest this, maintaining that India pursued a balanced, principled negotiation strategy throughout.

Global Trade Reset: Supply Chains, Currency Markets and Renegotiations

The SCOTUS ruling’s consequences ripple far beyond Washington and New Delhi. China, the European Union, and several emerging-market economies that had absorbed significant trade shocks under the Trump tariff regime are now expected to push for fresh bilateral and multilateral negotiations.

Supply Chain Recalibration: Winners and Losers

Global supply chains — already strained by pandemic-era disruptions and geopolitical tensions — are entering a new phase of recalibration. Trade analysts anticipate diversified sourcing strategies, reduced risk premiums on cross-border trade flows, and renewed foreign direct investment in previously tariff-penalised supply corridors.

Currency markets reacted with short-term fluctuations as traders repositioned around reduced tariff certainty. In the medium term, a more predictable US trade policy environment — subject to Congressional oversight rather than executive fiat — could stabilise currency dynamics for export-dependent economies.

What Happens Next? Three Questions That Will Define Global Trade

Three critical questions now dominate global trade discourse and will shape outcomes in the weeks ahead:

- Will Congress approve the 10% global tariff? With approval ratings near 30% and business groups lobbying against protectionism, Trump faces a steep Congressional climb.

- Will affected countries seek compensation or renegotiation? China, the EU, and key emerging markets are expected to table fresh bilateral demands at WTO and directly with Washington.

- How will multinationals restructure supply chains? Companies that diversified sourcing amid tariff uncertainty face a new calculus on whether to reverse or accelerate those shifts.

Strategic Undercurrents: Could Tariff Curbs Fuel Sanctions and Export Controls?

Some trade strategists warn the ruling could push future administrations toward alternative coercive economic tools — targeted sanctions, strategic export controls on technology and critical minerals, or sector-specific trade barriers — that may fall outside the Court’s newly defined tariff authority.

The ruling intensifies a broader constitutional debate about the scope of emergency economic powers and the limits of executive authority in a polarised political environment. Whether it becomes a constitutional footnote or a generational turning point in trade governance depends entirely on the political and legislative decisions that follow.

A New Chapter in US Supreme Court Tariff Policy and Global Trade

By invalidating the Trump tariff regime, the US Supreme Court has fundamentally redrawn the architecture of American trade authority. The ruling delivers a constitutional rebalancing — restoring Congressional primacy, offering cautious relief to India and global trading partners, and signalling that unilateral executive tariff actions face firm judicial limits.

For India, the ruling presents both an immediate export dividend and a strategic window for recalibrated US-India trade negotiations. For the global economy, it marks a potential reset in tariff politics — though the durability of that reset hinges on Congressional decisions, diplomatic responses, and corporate supply-chain strategies now unfolding in real time.

One thing is certain: global trade entered a new chapter the moment this ruling was announced — and its full consequences are only beginning to emerge.

FAQ: US Supreme Court, Trump Tariffs and India Trade Policy

Q: What did the US Supreme Court rule on Trump tariffs?

A: The Supreme Court struck down Trump’s global tariff regime 6–3, ruling that emergency economic statutes do not authorise blanket import tariffs without explicit Congressional approval. It is one of the most consequential trade rulings in US history.

Q: How does the SCOTUS tariff ruling affect India?

A: India, which faced tariff brackets of 18–25% on pharmaceuticals, textiles, and engineering goods, may see immediate export relief. The ruling also opens space for fresh India-US bilateral trade negotiations.

Q: Will the 10% Trump tariff still go ahead?

A: Trump has proposed a temporary 10% global tariff for 150 days via executive order, but it requires Congressional approval. Given low approval ratings and business lobby opposition, passage is uncertain.

Q: Can businesses claim refunds on tariffs already paid?

A: Potentially yes. Nearly $16 billion in tariffs collected under the invalidated regime may be subject to judicial review, and affected businesses are expected to file refund claims through US courts.

Q: What does the ruling mean for global supply chains?

A: Global supply chains — already strained by geopolitical tensions — are entering a new recalibration phase. Analysts expect diversified sourcing strategies, lower trade risk premiums, and renewed cross-border investment flows.

Q: What are LSI keywords related to this ruling?

A: Relevant search terms include: IEEPA tariff powers, presidential emergency tariffs, WTO trade renegotiation, US-India trade deal 2026, SCOTUS trade authority, Congressional tariff approval, and global supply chain diversification.

References:

https://apnews.com/article/supreme-court-tariffs-trump-0485fcda30a7310501123e4931dba3f9?utm_source