Patent expiry, generics and global consumption shifts could push Ozempic and Mounjaro into India’s mass market, reshaping obesity care and consumer spending

Ozempic India patent expiry, Mounjaro India launch, GLP-1 drugs India, semaglutide generics India, tirzepatide India market, weight-loss drugs India, obesity treatment India, GLP-1 economic impact, food industry disruption India, alcohol consumption trends India, WHO GLP-1 guidance

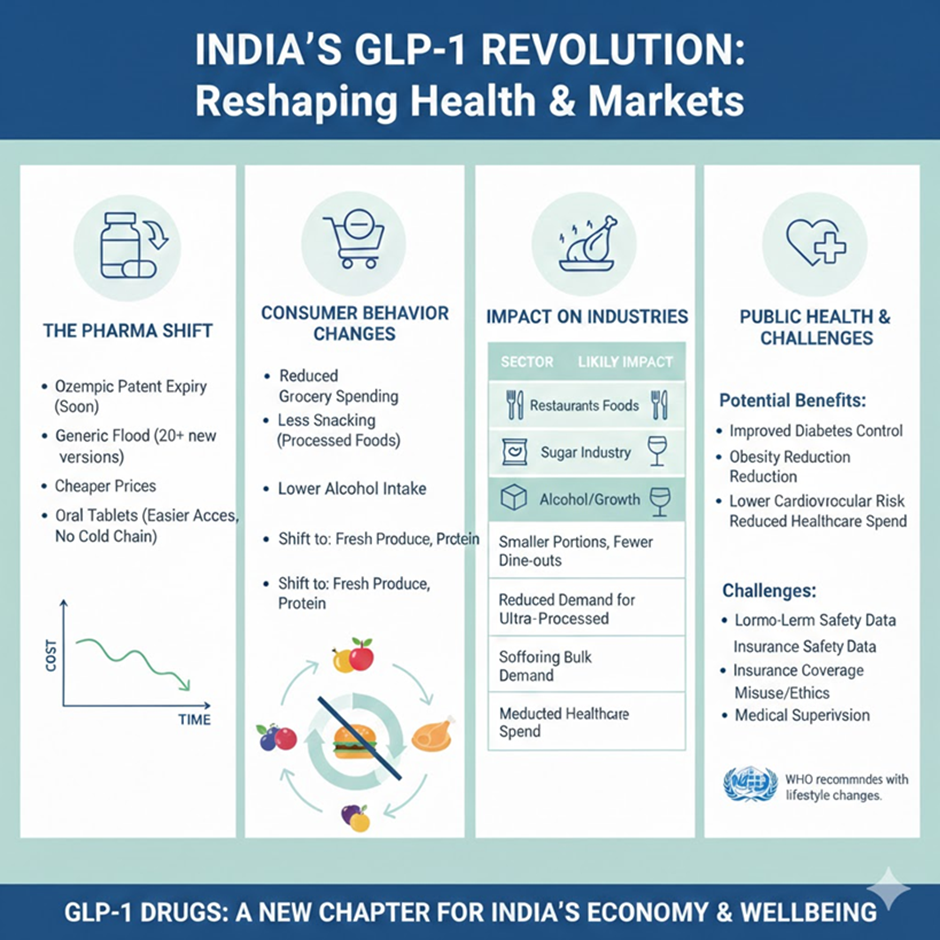

Ozempic and Mounjaro are poised to trigger far-reaching economic and public health changes in India as patent expiries, generic competition and global evidence of altered consumption patterns converge. With semaglutide’s India patent nearing expiry, domestic pharmaceutical firms are preparing cheaper alternatives — a move that could expand access to blockbuster GLP-1 weight-loss drugs and potentially disrupt food, sugar and alcohol demand.

Global data already show that households using GLP-1 drugs spend less on groceries, snacks and liquor. If India follows that trajectory, the ripple effects could extend beyond healthcare into restaurants, packaged foods and nightlife industries.

Ozempic and Mounjaro: From Diabetes Drugs to Weight-Loss Blockbusters

Ozempic and Mounjaro were initially developed for Type 2 diabetes but have rapidly emerged as leading obesity treatments worldwide. Both belong to a class of GLP-1 receptor agonists that regulate appetite hormones and insulin response.

Clinical trials show:

- 10–20% average weight reduction in many patients

- Significant lowering of blood sugar

- Improved insulin sensitivity

- Reduced appetite and food cravings

Endocrinologists describe GLP-1 therapies as a structural shift in obesity management, replacing fad diets and unregulated slimming regimens with medically supervised pharmacotherapy.

Global Impact: How GLP-1 Drugs Are Changing Economies

The economic footprint of Ozempic and Mounjaro is already visible internationally.

In the United States and United Kingdom:

- Households with GLP-1 users report nearly 10% lower grocery and restaurant spending

- Purchases of ultra-processed foods and sugary snacks decline

- Alcohol consumption shows measurable softening in certain consumer segments

Major global food and beverage companies such as PepsiCo, Coca-Cola and Kraft Heinz have begun pivoting towards high-protein and lower-calorie product lines in response to shifting consumer demand.

Analysts in the US estimate snack-food sales could decline by nearly $12 billion over the next decade if GLP-1 adoption continues rising.

Meanwhile, Novo Nordisk — manufacturer of semaglutide — has become one of Europe’s most valuable companies, significantly influencing Denmark’s economy through exports and tax revenues. The scale of pharmaceutical growth highlights how weight-loss drugs are influencing macroeconomic metrics.

Patent Expiry of Ozempic in India to Trigger Generic Competition

India now stands at a potential turning point.

As Ozempic’s patent protection approaches expiry in India:

- At least two domestic pharmaceutical companies are preparing generic semaglutide versions

- Industry estimates suggest more than 20 formulations could enter the market

- Competitive pricing may substantially reduce treatment costs

Currently, injectable GLP-1 therapies remain expensive for most Indians. A price correction could expand adoption among urban middle-income households.

Although Mounjaro’s patent remains valid, pricing pressure from semaglutide generics could narrow the premium gap.

Oral GLP-1 Drugs Could Accelerate Mass Adoption

Wegovy, a higher-dose semaglutide brand, has seen strong international uptake. Oral GLP-1 formulations under development may eliminate weekly injections and refrigeration needs.

Why Oral GLP-1 Tablets Matter for India

- Reduced cold-chain logistics in high temperatures

- Easier distribution via neighbourhood pharmacies

- Improved adherence

- Lower storage and transport costs

If oral versions match injectable efficacy, the weight-loss drug market could expand rapidly.

Impact on India’s Food, Sugar and Alcohol Sectors

India’s food ecosystem could see gradual behavioural shifts.

Global studies show GLP-1 users tend to:

- Eat smaller portions

- Reduce high-calorie snack purchases

- Shift towards fresh produce and protein-rich foods

If similar trends emerge in India:

| Sector | Possible Impact |

| Restaurants | Smaller portions, reduced dine-outs |

| Packaged Foods | Lower demand for ultra-processed snacks |

| Sugar Industry | Softening bulk demand |

| Alcohol | Slower per-capita consumption growth |

In Western markets, bars and liquor retailers have reported declining alcohol purchases among GLP-1 users. While India’s alcohol industry is structurally different, urban premium segments could experience moderation in growth rates.

WHO Recommendation on GLP-1 Drugs

The World Health Organization has issued conditional guidance on GLP-1 medicines such as semaglutide and tirzepatide.

Key recommendations include:

- GLP-1 drugs can be used for long-term obesity management in adults

- Behavioural interventions — diet and physical activity — must accompany medication

- Equity, cost and long-term safety data remain concerns

- Careful health-system monitoring is essential

The WHO stresses that while transformative, weight-loss drugs are not standalone solutions and must form part of integrated public health strategies.

Public Health Implications for India

India faces a dual burden of obesity and diabetes:

- Over 100 million people live with diabetes

- Cardiovascular disease remains the leading cause of mortality

Expanded access to Ozempic and Mounjaro could:

- Improve glycaemic control

- Reduce obesity prevalence

- Lower cardiovascular risk

- Potentially reduce long-term healthcare expenditure

However, experts caution against indiscriminate use without medical supervision.

What Could Slow Adoption in India?

Despite optimism, several barriers remain:

- Long-term side-effect and safety monitoring

- Regulatory approvals for generics

- Limited insurance coverage

- Public misinformation and cosmetic misuse

Healthcare professionals emphasise screening and structured prescribing to prevent misuse.

Ozempic and Mounjaro May Redefine India’s Consumption Patterns

The rise of Ozempic and Mounjaro in India signals more than a pharmaceutical shift. As global data reveal declining snack, grocery and alcohol demand among GLP-1 users, India may soon confront similar consumption changes — particularly if generics reduce prices significantly.

With WHO backing conditional medical use and global economic evidence mounting, Ozempic and Mounjaro could reshape both public health outcomes and consumer markets. Whether the transformation delivers sustainable health gains will depend on affordability, regulation and responsible clinical oversight.

The GLP-1 revolution, already altering Western economies, may soon enter its Indian chapter.

FAQs

Q: What are Ozempic and Mounjaro used for?

A: They are GLP-1 receptor agonist drugs used for diabetes and obesity management.

Q: How are GLP-1 drugs affecting global food sales?

A: Studies show reduced spending on groceries, snacks and restaurants among users.

Q: What does WHO say about semaglutide and tirzepatide?

A: WHO conditionally recommends their use alongside diet and exercise interventions.

Q: Will Ozempic become cheaper in India?

A: Patent expiry may allow generics, potentially lowering prices.

Q: Do weight-loss drugs reduce alcohol consumption?

A: Global data indicate some decline in alcohol intake among GLP-1 users.

References

https://www.ndtv.com/lifestyle/mounjaro-in-india-ozempic-coming-soon-trump-fat-shot-drugs-8404208